Disruption 2020: Sublease Space Update

-

Sublease space in this cycle will surpass the previous cycle’s peak by a wide margin. This has the potential to significantly affect the trajectory of vacancy and rent.

-

Boston and San Francisco were early leaders in the rise of sublease space, but other markets are catching up.

- Manhattan added 2.3 million SF of new sublease space in July and August, and Los Angeles, 1.2 million SF in the same months.

- Houston sublease space grew by six blocks of 50,000 SF-plus in the third quarter-to-date, part of a one million SF increase, while in Dallas, sublease space has grown by two million SF since the end of Q2.

- Washington, D.C., subleasing has added 900,000 SF in Q3 2020 so far, and Boston, 560,000 SF.

- Sublease inventory in Chicago’s CBD is at levels not seen in over 10 years. Atlanta added 763,000 SF in July and August.

- We expect sublease space to continue to rise for the next 6–12 months as tenants assess their space needs.

Sublease space is increasing. Early movers were Boston and San Francisco, but other markets are starting to see a surge in space as the third quarter has gone on. More will be added over the next 6–12 months as tenants assess their space needs.

The total amount of sublease space on the market is already approaching the last cycle’s peak levels. Heading into the pandemic-led recession, sublease supply was trending at higher levels than it was shortly before the Global Financial Crisis (GFC). With 14.5 million SF of sublease space added in the second quarter, an increase of 11.7% in one quarter alone, total sublease space available stood at 139.1 million SF, just four million SF short of the record set during Q2 2009.

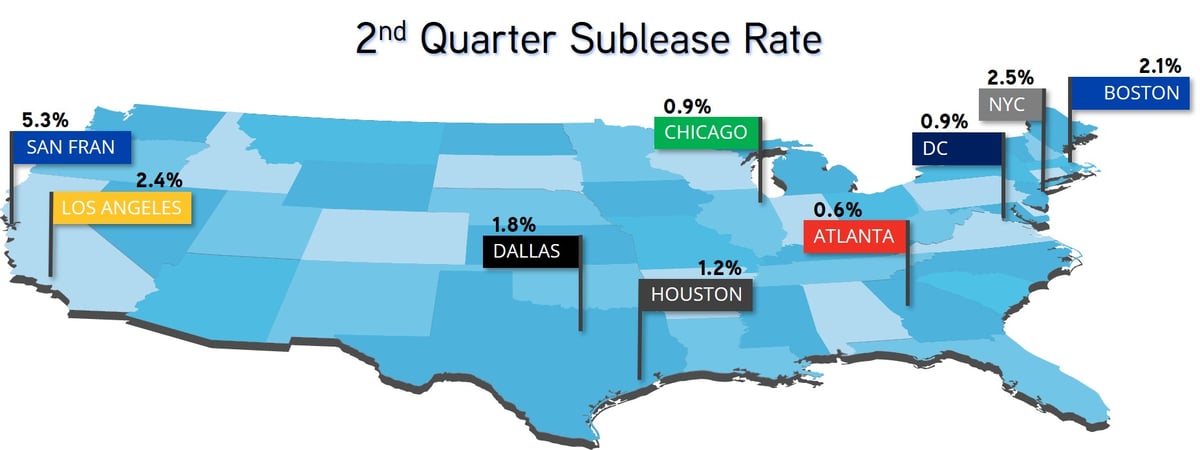

The visual below shows Q2 sublease rates across a number of major markets, which have been on the rise in Q3 2020 to date, suggesting that sublease volume in this cycle should surpass the previous peak by a fair margin. This has the potential to significantly affect the trajectory of vacancy and rents.

We caught up with our research leads across some of the biggest markets in the country, and the refrain was the same — sublease space is growing. Greater D.C. has added 900,000 SF ; Houston, one million SF, including six blocks of 50,000 SF or greater; Dallas, two million SF added quarter-to-date. Chicago’s CBD has the highest level of sublease space in over 10 years. Seattle’s sublease market is driven by spaces in the 20,000 SF–50,000 SF range. Manhattan sublease space grew by one million SF in July and another 1.3 million SF in August. Sublet inventory accounts for 23% of Manhattan’s total availability. In Los Angeles, 1.2 million SF was added in the same time; in Boston, 560,000 SF; Atlanta, 763,000 SF, including a 108,000 SF block put on the market by Macy’s. Twitter put 105,000 SF of sublease space on the market in San Francisco, while AT&T added 336,000 SF in the East Bay.

|

GO SOCIAL

Share with your network

|

|

|

|

AUTHOR(S):

|