Disruption 2020: May RCA Sales Volumes

-

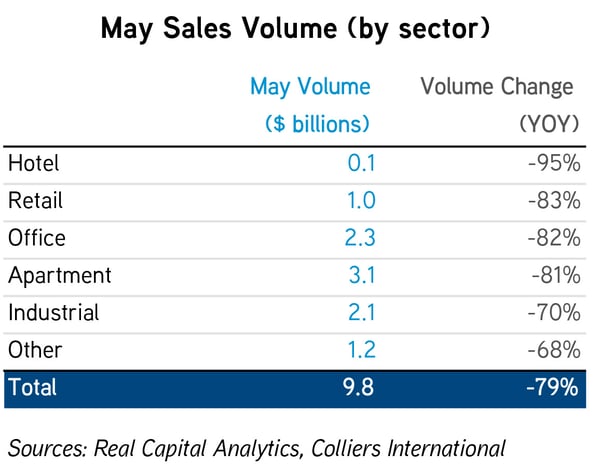

May sales volume was down 79% year over year, to $9.8 billion.

-

Industrial was the “best” performing, down by 70%.

-

Office volumes fell by 82%, and CPPI pricing indicates a slowing in value growth, up by just 1.6%.

-

Apartment led the market with $3.1 billion in volume, which was 81% lower. Pricing, though, is up 9.3%, the best growth for all asset types.

-

Retail dropped 83% and hotel by 95%. Hotel is the lone asset type posting value declines.

-

Safety is apparent in many top transactions, with investors seeking new assets, such as those with long-term leases in place or strong anchors, such as grocery stores.

-

Expect June figures to be even worse.

The latest Real Capital Analytics sales data for May is out, and unsurprisingly, volume continued to drop. After sales fell 71% in April, year-to-year, May sales volumes fell even further, off 79%. Volume was $9.8 billion. And the story does not look to change in June; at the time of this writing there have been no headline transactions (north of $200 million), suggesting that June figures could be even weaker. Some pending transactions could bolster sales somewhat, but the recent announcement from Simon Properties that it decided not to buy Taubman, takes a big portfolio sale off the table. Nationally, RCA reported that collapsed transactions increased to 3% of the total of closed deals in May, tripling from April figures. Pricing continues to rise, however, per RCA’s CCPI, up 4.9% across the asset types. Hotel is the lone underperformer, with pricing falling 5.8% over the past year.

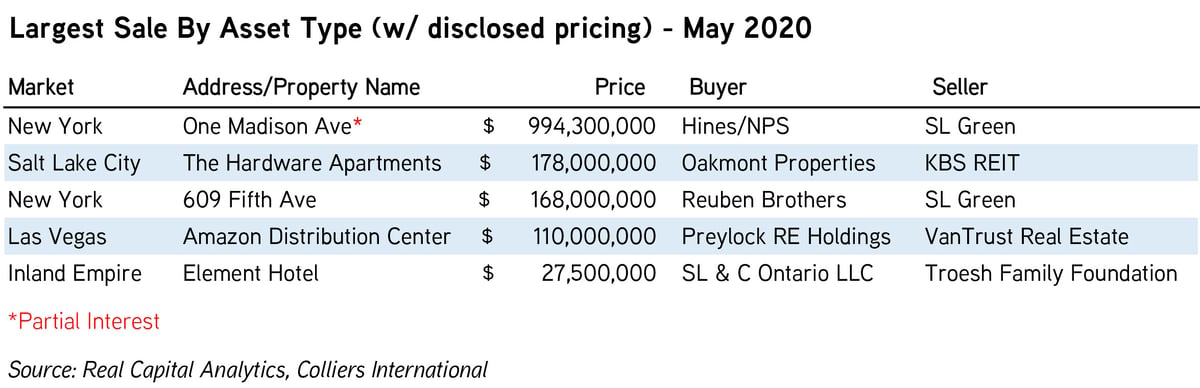

Industrial, with $2.1 billion in sales, did not attract major portfolio interest. However, volumes are off only 70% compared to year-ago figures, the “best” performance of the major asset types. New is winning out: An Amazon distribution center in North Las Vegas built in 2019 sold for $110 million, while another 2019-built asset, City of Hope on Alton Parkway in Irvine, CA, sold for $108 million. A 2016-built asset in Denver, CO, (Enterprise Business Center building 6) rounded out the top three sales, at $85.7 million.

A similar trend is apparent in the apartment market as well: newly built assets are hot commodities. Sales of the Hardware Apartments in Salt Lake City (2020 vintage), Modera Davis in Portland, OR (2020 vintage), and Fusion 355 in Broomfield, CO (2019 vintage), added up to $361 million of the overall apartment volume. Apartments posted the strongest monthly sales volume of any property type, at $3.1 billion. However, the total is 81% below year-ago levels. RCA’s CPPI shows a 9.3% increase in apartment pricing over the past year, by far the strongest-performing asset type.

Office volumes are off 82% year-over-year as of May, with volume of $2.3 billion. Suburban sales have declined more than urban office sales, down 86% versus 76%, respectively. RCA’s CPPI reveals slowing price appreciation, up just 1.6% over the past year. May volume was led by the purchase of a 49.5% stake in One Madison Avenue by Hines and the National Pension Service of Korea, partnering with SL Green on a $2.3 billion redevelopment of the asset. Another New York City asset, the Lever House at 390 Park Ave., also traded, for an approximate $240 million, to a partnership of Brookfield and Waterman Interests that took control in a debtor-controlled sale. The other top office sale was for Chicago’s Riverside Tower at 225 W. Wacker Drive for $210 million. Spear Street Capital acquired it at about the price it sold for in April of 2013.

Retail remains subdued, off 83%, with $1 billion in volume. The leading sale of the month was for a retail condo in New York at 609 Fifth Ave. for $168 million, featuring PUMA and Vince as tenants. There was a big drop-off in the second-largest sale, the Plaza San Remo in Coral Gables, FL, for $46.8 million. Safety was important, with high-street retail and a grocery-anchored deal topping the transactions.

Hotel sales were limited again, at just over $100 million. Being hit so hard during the COVID-19 pandemic, this product type has had plummeting occupancy, room rates, and, in turn, RevPAR. The largest transaction was the 2019-built Element Hotel in Ontario, CA., a 131-room property that sold for $27.5 million. A small portfolio in New England of Motel 6 properties was purchased by Global Hotel Group from Blackstone for $18.5 million.

As noted previously, volumes tend to pick up as the year progresses, with summer sales typically strong. However, we expect June data to be even weaker. We will continue to monitor conditions across asset types throughout the country.

Author:

|