Disruption 2020: July RCA Sales Update

-

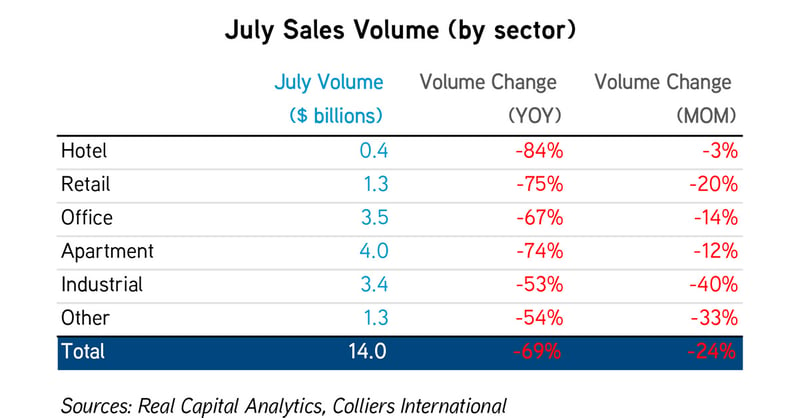

Volume was down $4.4 billion month-over-month, preventing a second consecutive month of gains. All asset types saw a monthly decline in volume.

-

Overall sales volumes were down 69% from last July, with outsized declines for hotel, retail, and apartment properties.

-

Amazon fulfillment centers continue to be among the most liquid assets anywhere.

-

Terminated transactions have increased, headlined by a Vornado retail portfolio in New York.

-

We sense that sentiment is continuing to slowly improve in the transaction markets, thanks to plentiful capital and a fully functional debt market.

-

Month-to-month volume comparisons should start to pick up, as more deals have launched this summer.

While sales remain well below last year’s levels, in July several large-scale transactions boosted volumes. The two largest deals were for nontraditional asset classes. The largest, for a three-asset portfolio of Harrah’s properties in New Orleans, LA, Laughlin, NV, and Atlantic City, NJ, was agreed to in June 2019. They sold for $1.82 billion after the completion of the Caesars/Eldorado merger. This transaction falls outside of Real Capital Analytics’ hotel volume, and as such is not reflected in the comparison chart and aggregate volumes. The second, Blackstone’s 49% stake in Hudson Pacific’s Hollywood Media Portfolio, a mix of office and studio facilities, was valued at $1.65 billion and includes future development potential.

July did not become the second straight month of improving investment sales volumes in aggregate. Total volume was $14 billion, down $4.4 billion from June. Aggregate volume remains down 69% year-over-year, with outsized declines in hotel, retail, and apartment properties. Office was roughly at par with aggregate volume declines, while industrial and other sales (driven by development sites) were off by slightly more than half. Please note that apartment volume could be revised up significantly, as Dalan Management is under contract on a 10-property portfolio in Brooklyn, NY, for $1.25 billion, which would shift that asset type from month-to-month declines to gains. July did not become the second straight month of improving investment sales volumes in aggregate. Total volume was $14 billion, down $4.4 billion from June. Aggregate volume remains down 69% year-over-year, with outsized declines in hotel, retail, and apartment properties. Office was roughly at par with aggregate volume declines, while industrial and other sales (driven by development sites) were off by slightly more than half. Please note that apartment volume could be revised up significantly, as Dalan Management is under contract on a 10-property portfolio in Brooklyn, NY, for $1.25 billion, which would shift that asset type from month-to-month declines to gains.

In July New York returned to its spot at the top for the largest office deal, $435 million for 1375 Broadway. Philadelphia followed closely behind, with the two-property One and Two Commerce Square selling for $383.3 million. Amazon fulfillment centers remain as liquid as any asset, with two facilities in Jacksonville, FL, and Kansas City, KS, selling for $214 million, headlining true industrial sales (the aforementioned studio space in Los Angeles has contributed to industrial volume). Retail remains sluggish, with the largest deal an 18,000 SF property at 8 Newbury Street in Boston for $42.5 million, one of the highest $/SF deals ever seen in Boston. Hotel sales, too, have been limited, led by the hotel portion of Wanda Vista Tower in Chicago, IL, the Renaissance Baltimore Harborplace, and Union Station Hotel in Nashville, TN.

Life science investment remains a driver for Boston; Alexandria agreed to purchase One Upland Road Norwood, Moderna’s suburban manufacturing facility, and also bought land in Watertown for future development. Meanwhile, IQHQ has agreed to buy GCP Applied Technologies’ headquarters in Cambridge, which is expected to be repositioned/redeveloped with a heavier lab component. Deals have continued in August, showing the strength of lab investment.

Terminated transactions have also increased, headlined by a Vornado retail portfolio in New York, the Campus @ Warner Center in Woodland Hills, an office property, and Renaissance Waverly hotel in Atlanta. This isn’t surprising, and other deals will be re-traded or put on hold.

Sentiment in the investment market continues to slowly improve. Capital remains plentiful, and the debt markets are fully functional. That provides a strong recipe for future sales, but we expect a choppy recovery for what is still far from a normalized investment market. Month-to-month volume comparisons should start to pick up, as more deals have launched this summer.

|

GO SOCIAL

Share with your network

|

|

|

|

Authors:

|