Disruption 2020: Venture Capital In Focus

-

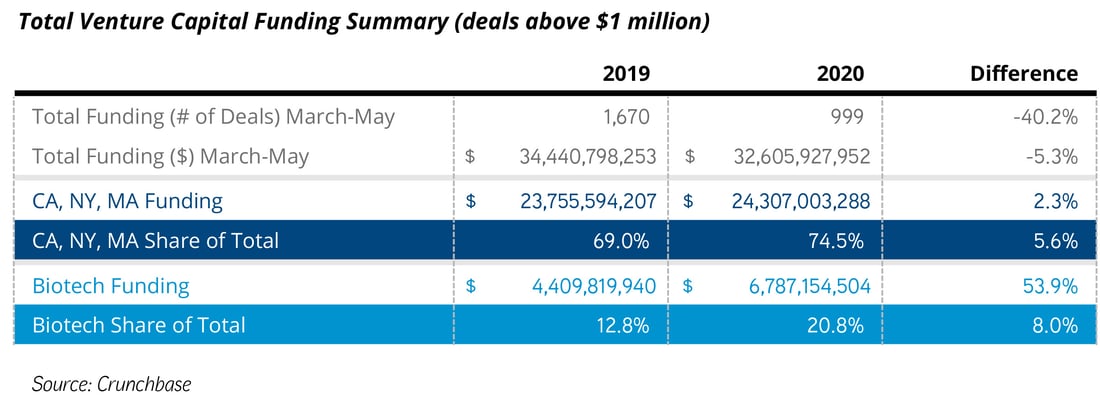

Venture capital (VC) deals fell by 40.2% year over year nationally from March to May 2020.

-

However, dollars invested were off just 5.3%.

-

A consolidation is readily apparent: California, Massachusetts and New York firms received 74.5% of all VC dollars. Funding is up 2.3% over the past year and this is creating a concentrated set of metro areas as winners.

-

Capital is also pivoting. Biotech gobbled up 20.8% of VC dollars, up from 12.8% the year before.

-

Greater Boston, the Bay Area and San Diego are the big winners, capturing 71.6% of biotech-focused VC dollars.

Venture capital deals fell nationally from March to May 2020 year over year, but the total capital invested was not off dramatically. Capital is vital to tech and life science firms, and venture capital is a key source. Its consolidation is creating a concentrated set of metro areas as winners.

As noted in our recent post on investment volumes declining substantially, deal totals in the VC world are likewise off 40.2% from March to May 2020, year over year, per data from Crunchbase. Crunchbase tracked 999 deals in the March-May period in 2020, compared to 1,670 in the same period in 2019. However, the total of aggregated funds raised fell less dramatically. We found that from March through the end of May, deals totaled $32.6 billion (using pre-IPO sources, non-debt-related fund-raising, and inclusive of private equity), a 5.3% drop from the same period a year before ($34.4 billion). For this analysis we used a $1 million investment criteria as the cutoff.

Other interesting takeaways: California, Massachusetts and New York firms received 69% of all VC dollars in 2019, but 74.5% this year. VC volume in these three states is up 2.3%, driven by California. Investment funds are pivoting toward biotech, the shining star among industries, which received 20.8% of VC dollars in this period in 2020, up from 12.8% a year earlier. Biotech investment is up 53.9% over the past year. This is particularly valuable for markets like Boston and Cambridge, San Francisco and the Bay Area, and San Diego. In fact, they captured 71.6% of all biotech-focused VC dollars.

Author:

|