Disruption 2020: Public Market Update

-

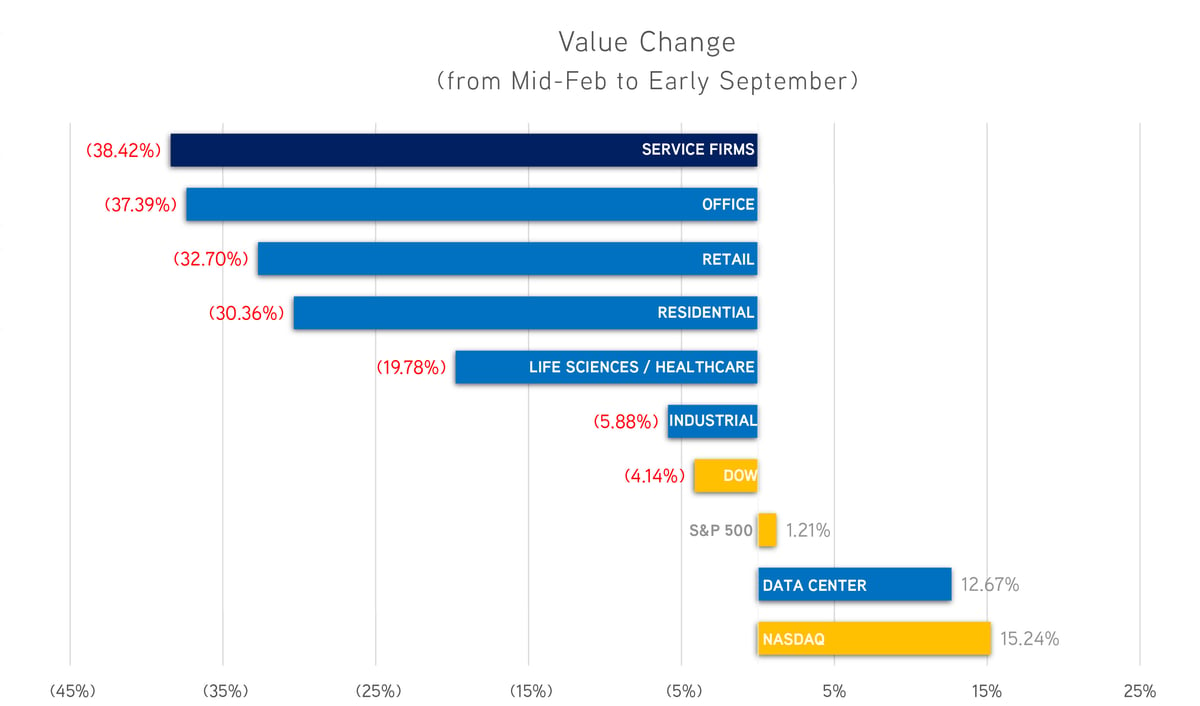

REIT stock performance has significantly lagged behind the broader stock market indices, compared to both the pre-pandemic stock market peak and our last analysis in May.

-

Office is the weakest-performing sector of all, while in May, retail was.

-

Data centers have performed the best, rivaling the expansion of the NASDAQ index since February. Industrial has been the best-performing large sector in that time frame.

-

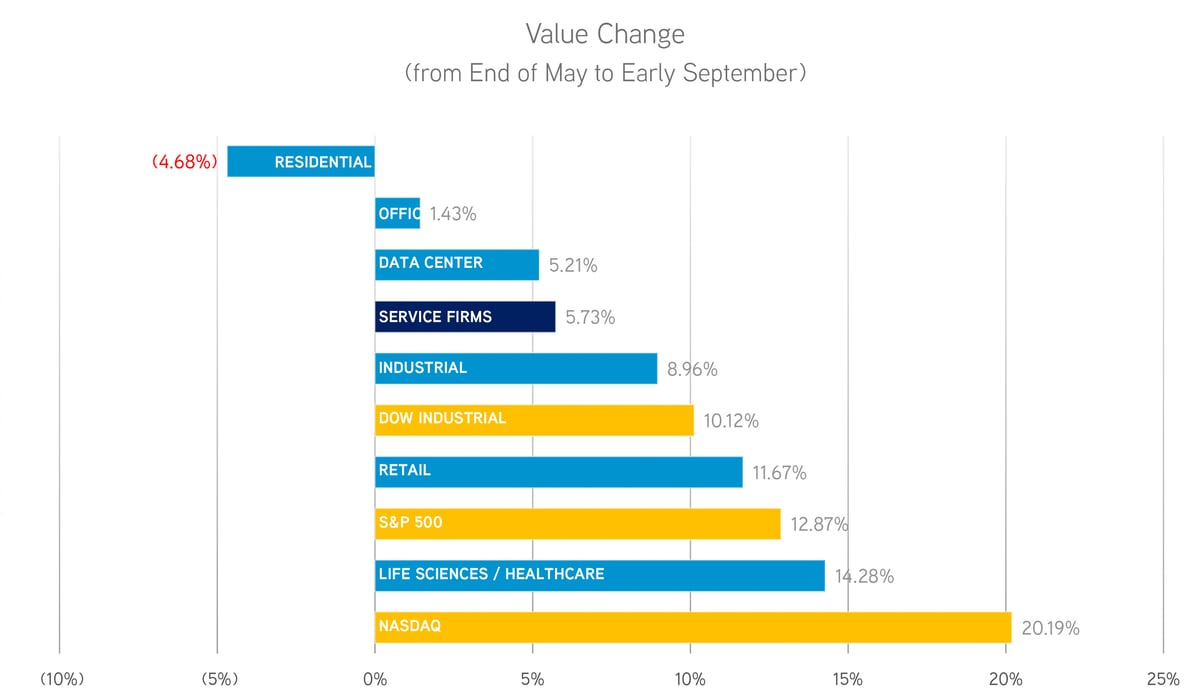

Since our last analysis, life science/healthcare has posted the strongest gains, followed by retail.

-

Residential is the only sector in which growth has declined since late May.

-

Alexandria Real Estate Equities, which focuses on only pure life science, has nearly returned to its pre-pandemic high.

-

Real estate services companies have rebounded of late, led by Colliers International.

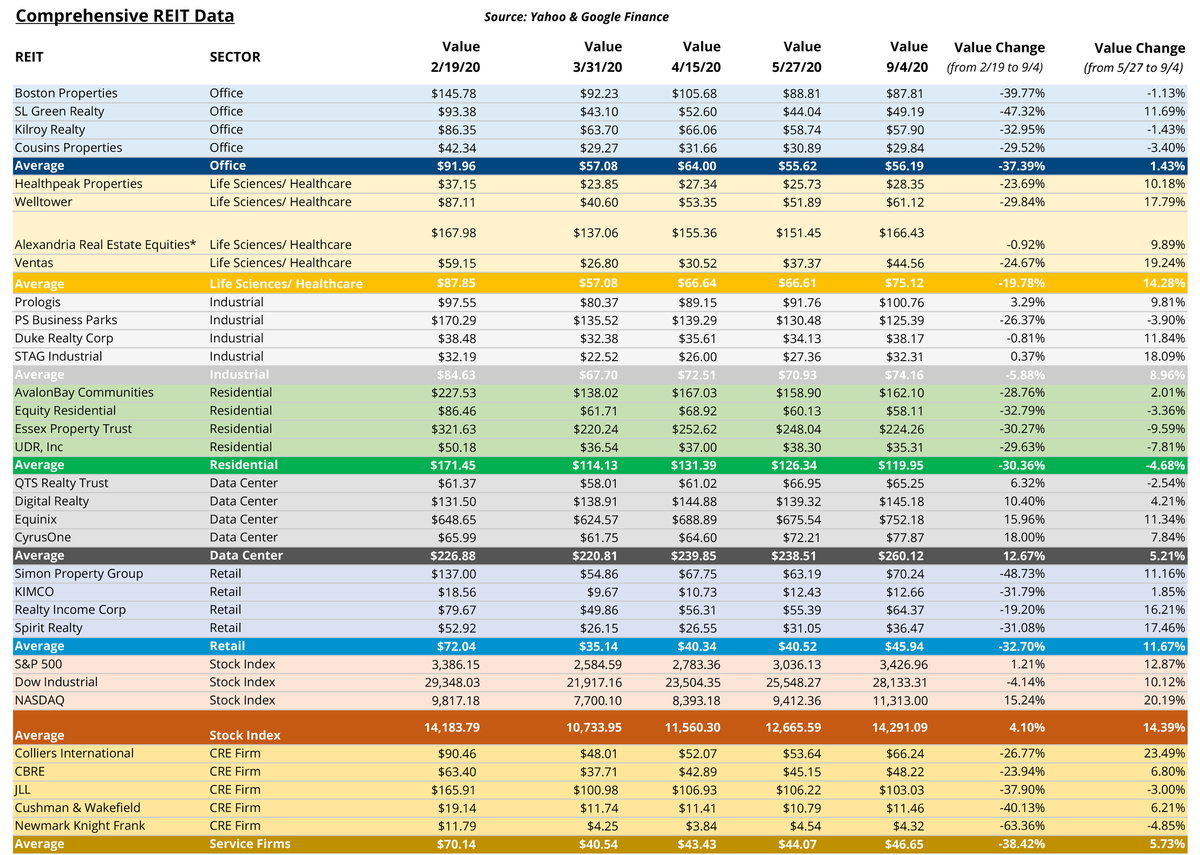

Building on our last Disruption piece on the public market’s performance both historically and during the early stages of COVID-19, we are taking a look at some new developing trends. Using the same four large public REITs in each sector (determined by market cap and market relevance) revealed that REITs have underperformed the recent stock market surge. While other U.S. stock indices were revitalized in recent months, the REITs in our index posted an average stock increase of just 6.1% from May 27 to September 4. From February 19, the starting date for our last REIT analysis, to September 4, the values of data center companies increased by 12.7%, followed by losses in industrial (5.9%), healthcare (19.8%), residential (30.4%), retail (32.7%) and office (37.4%) — an average stock decline of 18.9%.

The office sector in particular has been stuck in neutral; values barely increased (up 1.4% during that span). Three out of the four office companies in our index declined. Uncertainty about returning back to work has halted the sector’s growth and forced company executives to rethink real estate strategies. Many firms have also realized that working remotely hasn’t had the negative effects initially feared. Overall, the office sector had the weakest overall stock performance of any property type.

Source: Yahoo! Finance and Google Finance

Multifamily growth is similar, decreasing 4.7% during the same span, weighed down by softening rents in a number of markets, rising concessions, and residents’ ability to pay their rent.

Data centers and industrial continue to be the best-performing sectors. The industrial sector has heavily benefited from the rapid and continued rise of e-commerce in the past few years, coupled with increased delivery demand in this current climate. Data centers, though, are unique, historically less impacted by economic downturns. And the heavy need for technology infrastructure during the pandemic has boosted data center REIT performance.

Source: Yahoo! Finance and Google Finance

Alexandria Real Estate Equities, the only pure life science play in our healthcare category, posted a value decline of just 0.9% in the mid-February through September 4 period. Life science continues to be the property type of choice throughout the Boston market, and with strong NIH funding, venture capital and IPO activity, the life science market is outperforming office in all facets. Investors and developers are still clamoring for development sites and conversion plays.

We also added to the index five of the major publicly traded commercial real estate services companies, which are so closely tied to the overall conditions of the commercial real estate market. As a unit, these services companies have posted a 5.7% gain in the May-September timeframe, outperforming multiple REIT sectors. The leader in that group: Colliers International, increasing by 23.5%. That is the strongest performance among all companies, sectors and indices in this analysis — from end of May to the beginning of September.

[click to enlarge image]

The trajectory of our recovery will largely be tied to success in mitigating the pandemic. As the nation is well underway in restarting its economic engine, diligence in keeping the spread of COVID-19 under control will continue to pave the way for a robust second half of the year that will continue into 2021 and beyond. As a result, Consensus Economics forecasters are projecting a notable decline in the unemployment rate, from 9.1% in 2020 to 7.4% in 2021. While this is still a far cry from the sub-4% pre-pandemic unemployment levels, as we look forward, the continued employment gains and projected GDP growth should help to re-energize the commercial real estate industry.

|

GO SOCIAL

Share with your network

|

|

|

|

AUTHOR(S):

|