Disruption 2020: June Sales Data - Signs of Improvement?

-

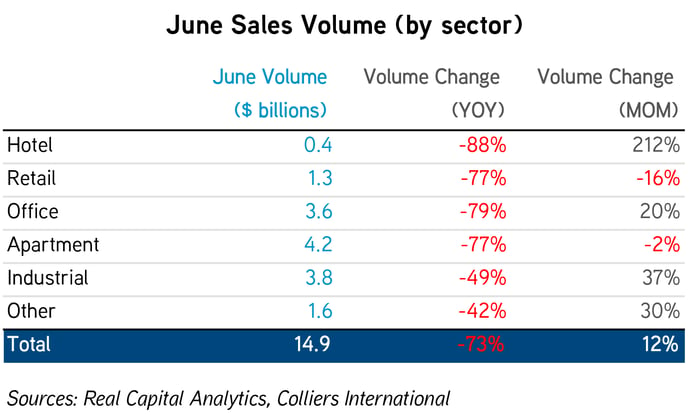

June sales volumes were off 73% year-over-year, outpacing the declines of April and May.

-

RCA has noted an increase in distress, led by hotel and retail.

-

However, sales volume was up 12% month-over-month to $14.9 billion.

-

Industrial had the “best” performance, declining 49% over the past year, though monthly volume was up $1 billion.

-

Office declined 79% (CBD sales were down 83%, suburban 76%), apartment 77%, June to June. Office saw monthly sales increases, apartment was flat.

-

Retail and hotel remain challenged, off 77% and 88%, respectively. Hotel volume surged in June off of very low levels.

-

July may be the bottom of the market – deals are starting to come to market, but we expect the recovery to be choppy.

The slowdown in investment volumes witnessed the past couple months continued in June. Volume was down 73% when compared to a year ago, outpacing the declines of April and May (which includes updated figures). However, monthly sales figures were up, when compared to May, with $14.9 billion in activity. Overall volume in the second quarter was about one third of the level from one year prior, per Real Capital Analytics (RCA). First half volumes were 68% lower than last year, and it wouldn’t be surprising to see July as the bottom of the market. Deals are starting to come to market, particularly multifamily given the favorable financing terms available for that asset class. Fits and starts are expected, as the trajectory of COVID-19-related cases vary widely across the country. While one part of the country may show signs of improvement in sales volumes, another may slow due to local health concerns. The recovery is likely to be choppy.

In addition to the investment pullback, distress is mounting. RCA has noted more than $30 billion of distress in the second quarter, in line with quarterly levels from 2009. This is unsurprisingly driven by two asset types, retail and hospitality, which account for over 90% of all distress. What RCA deems as potentially distressed assets is triple that figure, and includes all property types, with apartment and office accounting for 20%, and 15%, of that total, respectively.

Office volumes plummeted in June, totaling just $3.6 billion, down 79% from one year ago. With no major transactions in gateway markets, volumes fell off a cliff. CBD transaction volume fell 83% over the past year, while suburban sales were off 76%. As with overall volume, however, month-to-month volumes were up about $600 million. The largest deal was 1901 Market Street in Philadelphia ($360 million), which was purchased by Independence Blue Cross. The property is their headquarters.

Apartment volumes also dropped significantly. Declining 77% over the past year, these declines are in league with office and retail figures. Overall volume was flat month-to-month. Willard Towers in Bethesda, MD (500 units, $276.5 million sale) led the market in June. Despite this low volume, numerous apartment projects have been brought to market, so we expect to see increasing volume in this asset type.

Industrial again had the “best” performance, off 49%, and an increase in volume over May of $1 billion. Of the ten largest deals across the country in June across all property types, industrial had two of them, with an Amazon-leased facility in Kenosha, WI and a newly built LG Electronics property in Somerset, NJ leading the way. Industrial is still a favored asset type, and while volumes are down, these deals are easier to transact, relative to other properties.

Hotel remains hard-hit, but with properties reopening, and occupancies and RevPAR increasing, fundamentals are improving, albeit, at significantly lower levels than expected. Volume was down 88% in June, which is an improvement from the declines in April and May that topped 90%. Sales in June were higher than April and May combined. The top deal in June was the $180.3 million sale of the James Hotel at 88 Madison Avenue in New York.

Retail deals are dominated by smaller transactions of less than $7 million. Overall volume was off 77% compared to last year. Volume last June was off 56% from the prior year, so these declines are off of relatively low figures to begin with. The largest deal was Town Center North in Oceanside, CA, which sold for $24.5 million, and is anchored by a Vons grocery store. A former JC Penney in Norfolk, VA was sold for $20 million, as the site is planned for a redevelopment to office. Pharmacy deals such as CVS and Walgreens, and grocery sales, including Aldi locations were popular. Pharmacy deals are easier to transact given their triple-net lease structures.

|

GO SOCIAL

Share with your network

|

|

|

|

Authors:

|