Disruption 2020: Industrial Activity Maintains Momentum

Despite facing headwinds of record unemployment rates, negative GDP growth, and rising cases of COVID-19 across the country, the U.S. industrial market is poised to maintain its footing with low vacancies and high asking rents across most markets. Overall net absorption remained positive, and new supply is primed for a record year in 2020. The continued growth in e-commerce sales in the U.S. is a top demand driver, fueling demand for warehouse and distribution space amid the global pandemic, particularly from Amazon. Quarterly U.S. industrial investment sales volume, however, dropped approximately 50% from this time last year, yet prices held firm. Despite the drop in transactions, industrial is the only property type earning positive year-over-year growth.

Here are some of the headline numbers from Q2 2020:

- The U.S. industrial vacancy rate rose for the fourth consecutive quarter to 5.5%.

- Net absorption stayed positive, with occupancy gains of 104.5 million SF year-to-date, or 6.2% higher than this time a year ago.

- Low vacancy in both core and secondary markets and new, higher-quality space drove average asking rents to a record $6.29/SF for warehouse/distribution space, or 1.6% growth, in Q2 2020.

- Despite quarterly investment sales volume softening, year-to-date transactions totaled $44.5 billion — up 17.2% — due to a very strong first quarter. In the second quarter, transactions fell to 866, compared to an average quarter of 1,900.

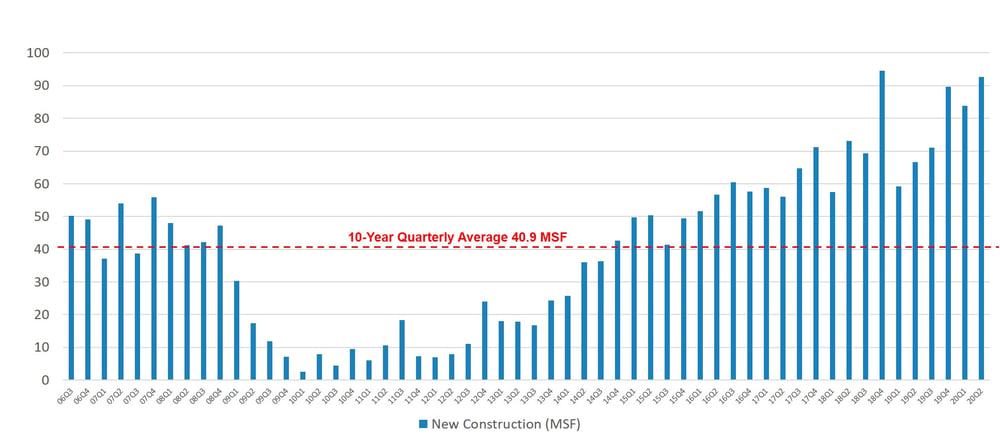

- New industrial supply through Q2 totaled 171.9 million SF, up 33.5% from 128.8 million SF last year.

- Development remains heavy, with 313.6 million SF underway at the close of the quarter, nearly equal to the 312 million SF at midyear 2019.

Most Quarterly New Supply Since Q4 2018

U.S. Industrial Outlook

The explosion of e-commerce demand, largely due to the global pandemic, has kept industrial product in high demand. The mass appeal of quick delivery options and vast selection of merchandise also propel the need for industrial distribution space. Online grocery shopping, a fast-growing segment of e-commerce, surged due to safer-at-home initiatives in many parts of the country, generating the need for cold-storage space as well. The pandemic has fueled growth in the industrial sector even as the broader economy grapples with the adverse impacts of COVID-19.

To illustrate this, Amazon occupied a whopping 20.9 million SF in just the second quarter alone — its highest quarterly growth thus far. In fact, it has already transacted more space than it did in 2018 or 2019, occupying a total of 26.9 million SF at midyear. Amazon also plans to expand its footprint by 50%, solidifying its growth trajectory in the quarters to come.

Rapid e-commerce growth will continue to drive development in the U.S. At current levels, the U.S. industrial market is on pace to set a record for new supply delivered in 2020, surpassing the 294 million SF record in 2018. Supply chains continue to be retooled while companies move forward with strategic decisions to keep more inventory on hand, both of which could benefit the industrial sector. Whether states walk back pandemic reopening efforts or continue with phased reopenings, changes in the way we live and purchase goods support further growth in the industrial sector.

|

GO SOCIAL

Share with your network

|

|

|

|

AUTHOR(S):

|