Disruption 2020: Equity Capital Ready to Deploy

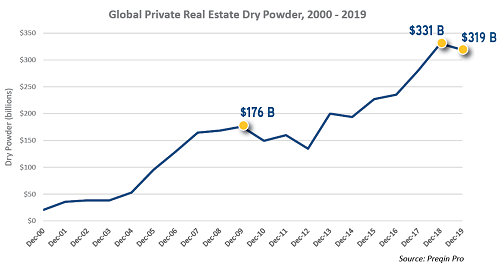

- $319 billion of dry powder on the sidelines at the end of 2019 — equity isn’t a problem

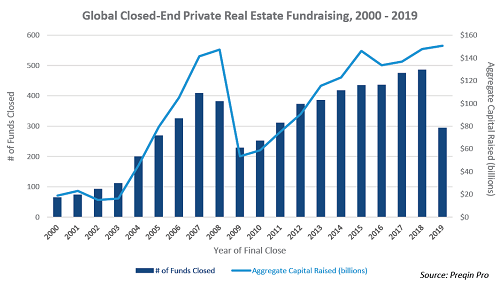

- Consolidation of funds continue — 72% in one fund as compared to only 61% in the prior year

- Westbrook Partners ($2.5 billion), Walton Street Capital ($1.5 billion), Madison International Realty ($1.2 billion), TA Realty ($1.2 billion) led closed funds in Q1 2020 – 80% focused on value-add and debt

- Trending/Caution: Q1 2020 fundraising was down more than 50% from last year

In the commercial real estate market today, liquidity is right up there among its many concerns. The equity side of the business, however, is well stocked, with $319 billion of global private real estate dry powder at the end of 2019 (per data from Preqin); just slightly lower than the all-time high of $331 billion at the end of 2018. In comparison, equity peaked at $176 billion in 2009 — equity isn’t a problem today.

Fundraising remained strong through the end of 2019, with a record $151 billion raised in global closed-end private real estate funds, slightly higher than the previous cyclical peak of $147 billion in 2008. The key difference is the amount raised per fund; it was $125 million larger in 2019, as investors were consolidating their investments into one fund. This trend continued in the first quarter of 2020, when an average of 72% of capital was dedicated to one fund, while one year prior, that figure stood at 61%. Investors have targeted debt and value-add strategies, while core, core-plus and opportunistic investments have declined. Not surprisingly, overall fundraising dropped at the start of the year by more than 50% from the prior year ($18 billion in 2020 versus $51 billion in 2019).

The four largest funds closed in the quarter covered the spectrum of strategies. Westbrook Real Estate Fund XI raised $2.5 billion for its global fund focused on value-add, Walton Street Real Estate Debt Fund II raised $1.5 billion for a North American debt strategy, Madison International Real Estate Liquidity Fund VII topped $1.2 billion for North American and European core investment, and TA Realty Associates XII raised $1.2 billion for a North American value-add fund. Overall, in the quarter funds focused primarily on value-add and debt (80% of capital) — opposite sides of the investment spectrum.

Authors:

|