Disruption 2020:Consensus Economics August Forecast

-

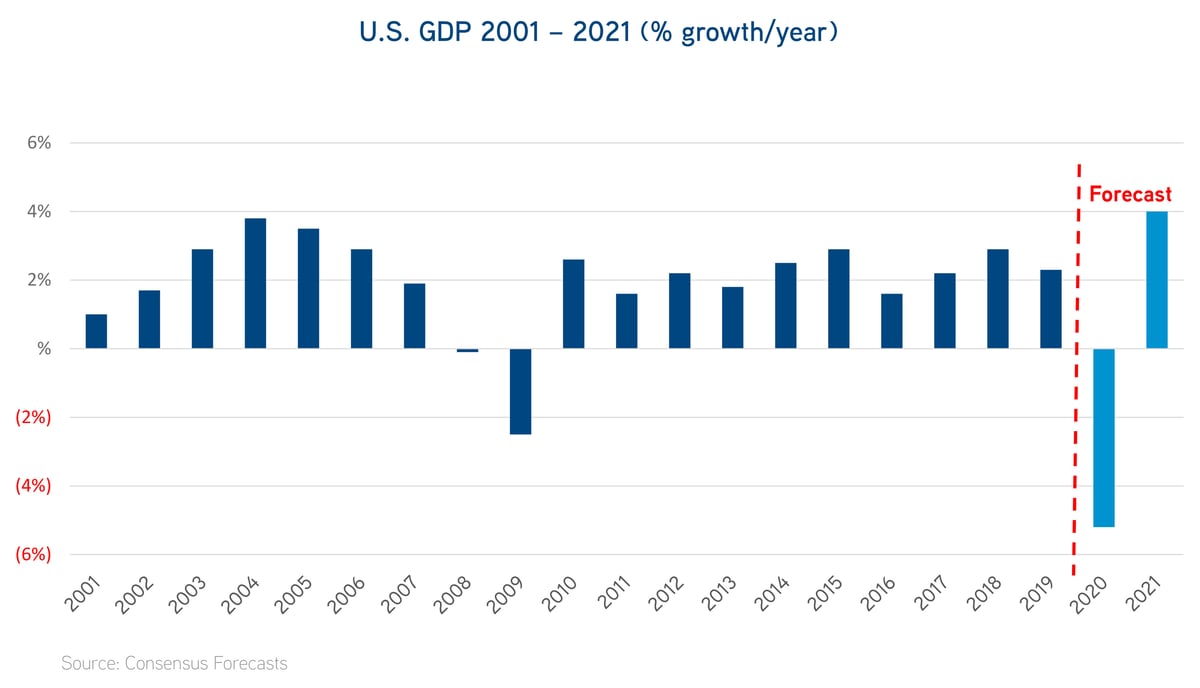

The Consensus Forecast for August predicts a 5.2% annual decline in real GDP in 2020, followed by positive growth to 4.0% in 2021. These predicted rates are a 40 basis point difference from the June report (5.2% vs. 5.6%, and 4.0% vs. 4.4%).

-

As both the medical and business communities obtain greater clarity about the impacts of the pandemic, we see fewer consensus fluctuations month-over-month.

-

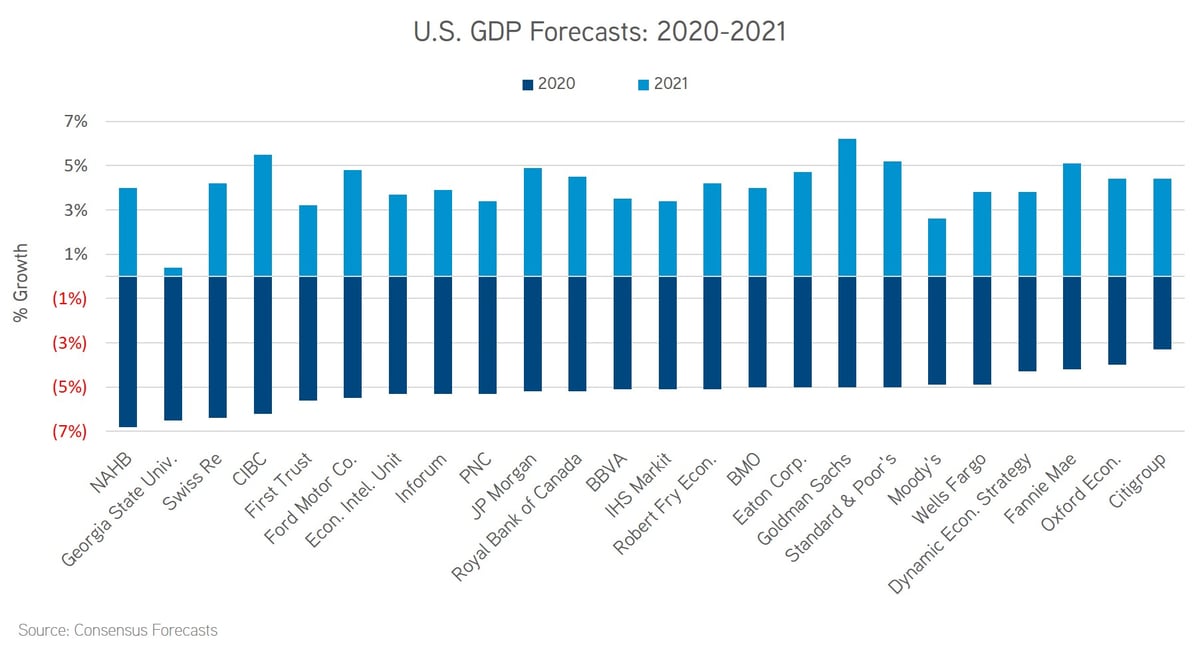

While all forecasts project negative growth in 2020, it varies widely in projections of the different forecasting groups.

-

Citigroup remains the most bullish of all forecasters for 2020, projecting just a 3.3% annual decline, while on the other end of the spectrum, the National Association of Home Builders predicts a 6.8% decline for 2020.

-

A “V-shaped” recovery is still the aggregate base case scenario.

-

Third quarter GDP forecasts have held steady at an expectation of a rebound of 20.7%.

On any given day, our inboxes are flooded with a cornucopia of market information ranging from the percentage of unemployed workers to the number of COVID-19 cases to the after-the-bell closing numbers on Wall Street. While a great deal of this information is historical in context, we also receive a litany of forecasts and predictions that often vary widely from firm to firm.

To resolve these discrepancies, Consensus Economics surveys a panel of 24 leading economic and financial forecasters for their predictions on an array of variables including economic growth, inflation, interest rates, and unemployment rates and publishes results in its monthly Consensus Forecast report.

While the recovery won’t be nearly as swift as the speed and depth of the pandemic’s initial impact on the economy, the second quarter was likely the nadir, with a 32.9% quarter-over-quarter contraction, on the heels of a 5% decline in the first quarter. Looking forward, initial estimates for the third quarter predict a sharp rebound of 20.7%. However, contracted spending due to the sunset of the initial $600-per-week federal unemployment boost plus recent spikes of COVID-19 cases flaring up in different parts of the country could reduce those projections.

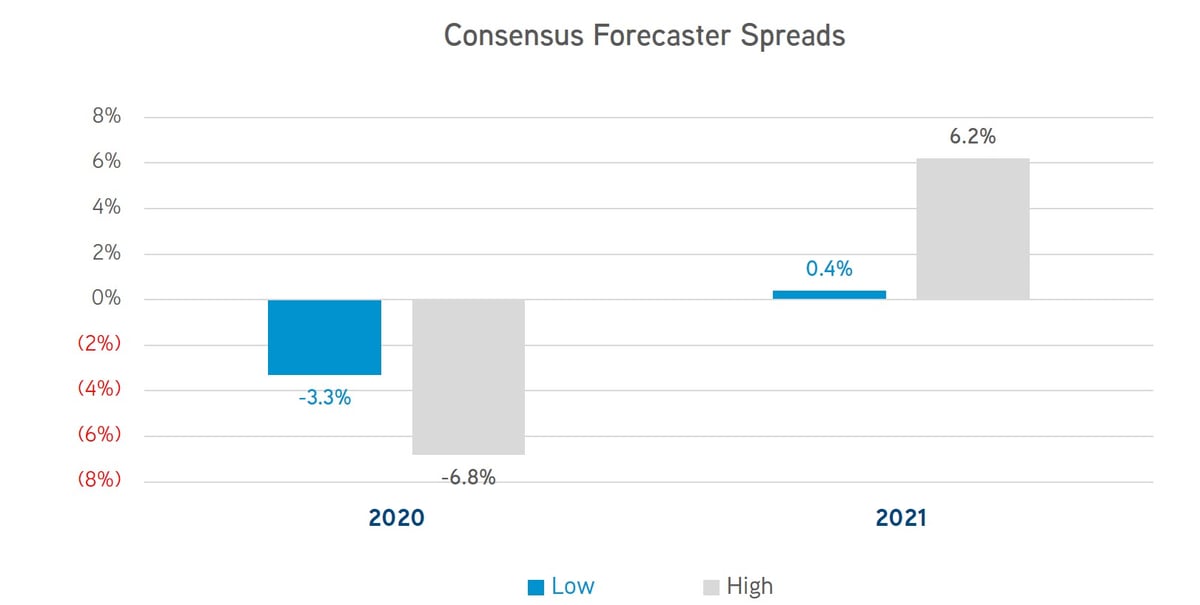

Nevertheless, despite an unimaginably bad second quarter, Consensus forecasters are expecting a real GDP decline of between 3.3% and 6.8%, with a mean decline of 5.2% on the year. This represents a 0.1-percentage-point improvement over July’s forecast. Citigroup was the most bullish of the forecasters by a considerable margin, projecting a drop of 3.3%. Oxford Economics was the second most bullish firm, projecting a 4.0% decline. Last month, Georgia State University was the most bearish of all forecasters at negative 7.2%. This month, Georgia State economists revised their projections to negative 6.5% and moved into second place, behind the National Association of Home Builders at negative 6.8%.

For 2021, the spread between the 24 forecasts widened from 550 basis points to 580 basis points. On the low end, Georgia State University is projecting a modest 0.4% gain, whereas Goldman Sachs is projecting an increase of 6.2%. The mean Consensus Forecast is for a gain of 4.0%, the same as July’s estimate.

The trajectory of our recovery will largely be tied to success in mitigating the pandemic. As the nation is well underway in restarting its economic engine, diligence in keeping the spread of COVID-19 under control will continue to pave the way for a robust second half of the year that will continue into 2021 and beyond. As a result, Consensus Economics forecasters are projecting a notable decline in the unemployment rate, from 9.1% in 2020 to 7.4% in 2021. While this is still a far cry from the sub-4% pre-pandemic unemployment levels, as we look forward, the continued employment gains and projected GDP growth should help to re-energize the commercial real estate industry.

|

GO SOCIAL

Share with your network

|

|

|

|

AUTHOR(S):

|