Disruption 2020: Consensus Economic Forecasts

-

This report is dated June 8th, which means many forecasts do not reflect the May jobs report and the improving sentiment as a result.

-

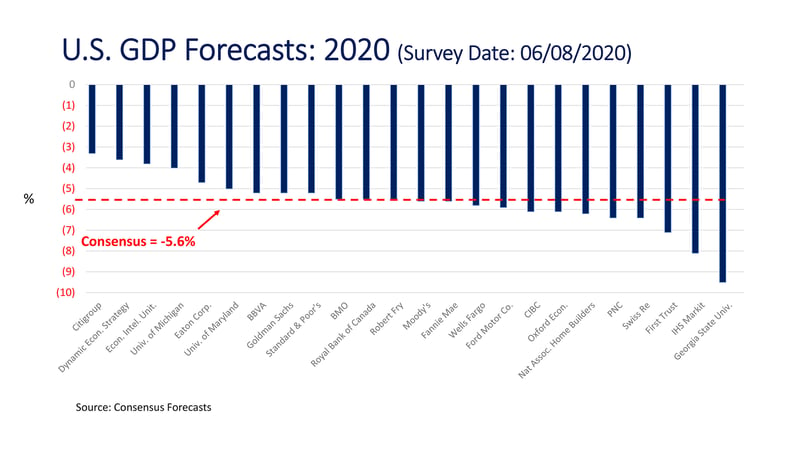

Month-to-month, the outlook for 2020 has become more sanguine, with a 5.6% GDP decline as the consensus. Citigroup is the most bullish, with a 3.3% decline predicted, while Georgia State University is the most bearish, expecting a 9.5% annual decline.

-

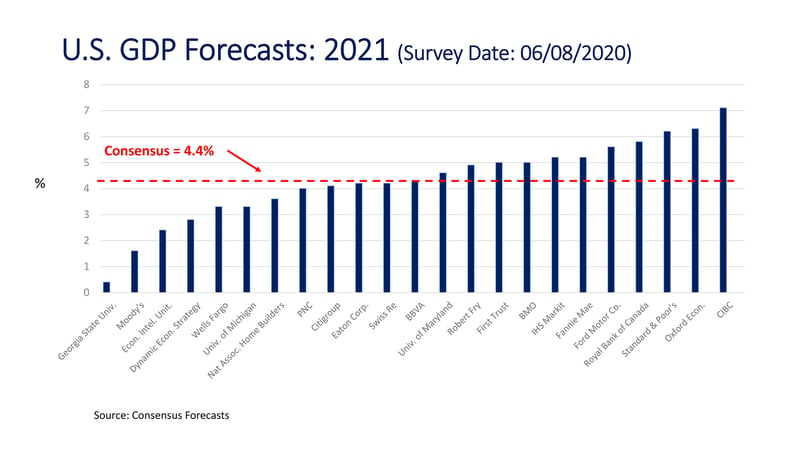

2021 on the other hand is more optimistic, with the consensus calling for a 4.4% GDP gain. Georgia State is the most bearish here as well, with a 0.4% increase in GDP forecast, while CIBC is the most bullish, expecting GDP to expand 7.1%.

-

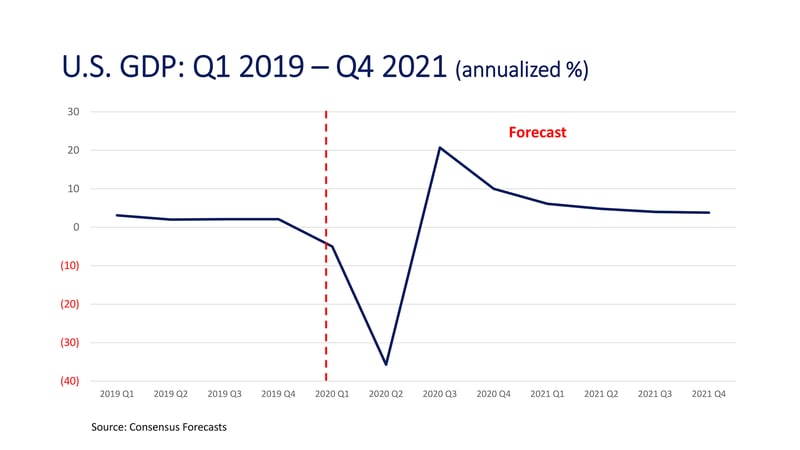

Overall, the second quarter of 2020 is predicted to post an annualized decline of 35.7%, while the third quarter is expected to rebound by 20.7%. This is a sharp, yet short retraction.

-

Strong intervention from the Fed and Government have propped up balance sheets and should, in turn, support commercial real estate. The wildcard is the future path of the pandemic, which is unknowable.

Each month Consensus Economics surveys a number of economic and financial forecasters on their expectations for a variety of economic data sets, including GDP. Despite the ongoing volatility in the stock market, late May/early June, particularly after the May jobs report was released, signs emerged of improving sentiment. This permeated to commercial real estate as well. This week, we examine the outlook for GDP growth in the U.S., based on the latest Consensus Forecasts. This forecast was dated June 8th and may not include each group’s response to the May jobs report. We should note, though, that GDP growth is of course only one metric of the state of the economy and recognize that real estate product verticals - specifically office, retail and hospitality - are expected to have longer and less steep recovery slopes.

The Consensus Forecast is created using 24 different groups ranging from banks, insurance companies, universities, rating agencies, government lenders, major business and trade associations, and forecasting shops. Looking at these groups, the consensus for 2020 U.S. GDP is a decline of 5.6%. This is right where Moody’s and Fannie Mae have set their expectations. The most bullish outlook is from Citigroup, with a decline of 3.3%, and Dynamic Economic Strategy at a loss of 3.6%. The most bearish come from Georgia State University at a 9.5% decline, and IHS Markit at an 8.1% loss. Month to month, the 2020 forecasts have moved out by 0.2 percentage points.

The outlook for 2021 has conversely increased 0.1 percentage point from May to June. The consensus outlook is for a gain of 4.4%. Similar to the 2020 outlook, there is a wide range of expectations. Georgia State University continues to be the most bearish, with a 2021 GDP forecast of just 0.4 percentage points. Moody’s, which was on the consensus line for 2020, is predicting a 1.6% gain in GDP in 2021. On the bullish side is CIBC, with a 7.1% expected GDP gain next year, while Oxford Economics and Standard & Poor’s are neck and neck with predictions of 6.3% and 6.2%, respectively.

A “v” shaped recovery is the consensus forecast for GDP growth. The second quarter is the predicted nadir, with a loss of 35.7% annualized GDP, followed by a rebound in the third quarter of 20.7%. This is a severe, yet short retraction. While this does not make up for the losses in the first half of the year, it suggests a strong rebound in the second half of this year. The wildcard is the future path of the pandemic, which is unknowable. Commercial real estate is driven by jobs and spending. Strong intervention by the Federal Reserve, and Federal Government have pumped trillions of dollars of liquidity into the system, including extra unemployment benefits, supporting personal balance sheets. This should lead to a rebound in spending, supporting jobs, and in turn, commercial real estate.

Authors:

|