Disruption 2020: August RCA Sales Update

-

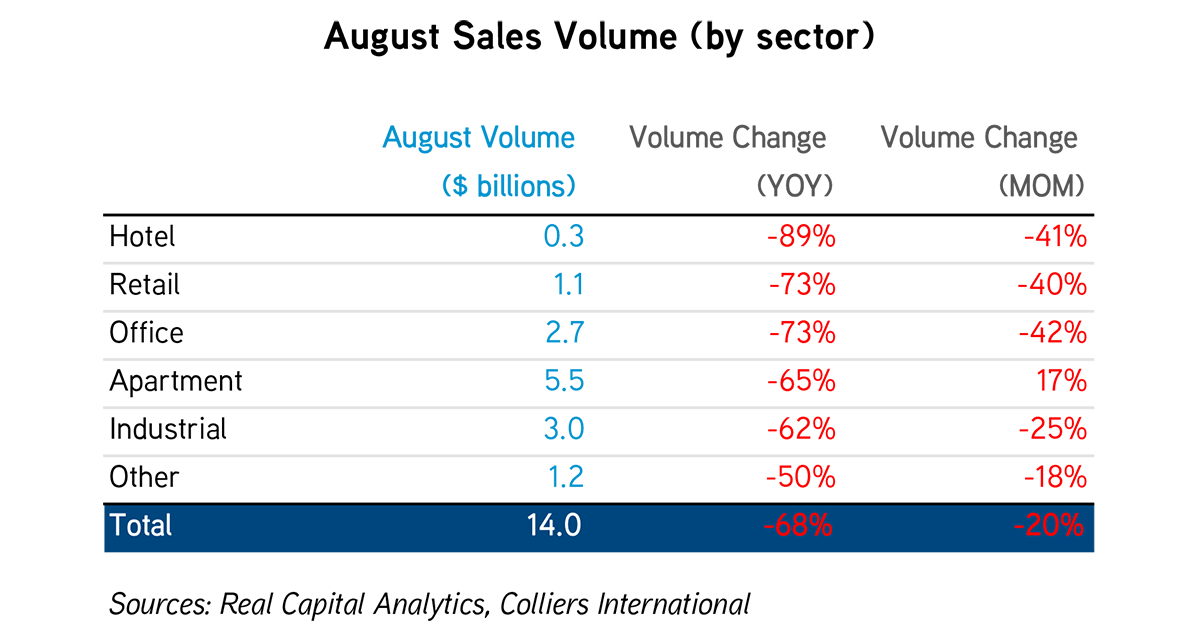

August sales volume came in at $14 billion, a decrease both of year-over-year by 68% and month-to-month by 20%.

-

Hotels continue to be the worst-performing sector, down 89% in sales volumes year-over-year.

- Apartments posted a 17% month-over-month increase to $5.5 billion in August, while sales in the office sector decreased by 42%.

- Transactions should start to pick up, as more and more deals are being launched.

August sales volume continued its slump, declining an aggregate 68% year-over-year. Massive sales remain elusive, holding back overall investment volumes across property types. Although monthly sales figures were down from July, more products are beginning to be brought to market, suggesting more deal volume in the months ahead. As the summer has ended, we are most likely at the bottom of this sales cycle, barring a second wave of COVID-19 cases.

OFFICE volume sales at $2.7 billion are down 73% from last August and 42% from July. The headline transactions of a six-property portfolio occupied by GlaxoSmithKline in RTP, NC, for $615 million and Broadcom’s headquarters in Irvine, CA, for $355 million drove volume. Unsurprisingly, the two largest transactions were single-tenant occupancy assets.

MULTIFAMILY was the only asset type whose sales volume increased month-over-month, by 17%. That trend should continue, as sales volume will surge in September thanks to a portfolio deal valued north of $2 billion. The largest deal in August was Southern Towers in Alexandria, VA, for $506 million, one of the largest single-asset sales of the year (the property comprises 2,311 units).

INDUSTRIAL continues to be the best-performing sector, with volumes down 62% year-over-year — lowest of all asset types — and a mere 25% over the past month. Single-tenant assets once again are easier to transact, and the largest deal in August was a newly built Home Depot distribution center in Dallas, for $247 million.

HOSPITALITY will continue to be volatile given the lack of volumes at the outset of the pandemic. Sales are down year-over-year by 89% and 41% from July. Sales such as for the Embassy Suites in New York on W. 37th ($115 million) are signs that investors are returning.

RETAIL volumes declined 73% year-over-year, and monthly volumes fell 40% from last month. The largest monthly sale looks somewhat ominous because of the challenges of this property type: A former Costco in Torrance, CA, sold for $81 million. It will be demolished and replaced by an industrial building.

As more and more products start to come on the market, sales volume should start increasing in the coming months. Capital also remains plentiful while the debt markets are fully functional. Blackstone recently closed on a record-breaking $8B real estate debt fund, which will mainly focus on distress assets.

This gradual shift in investment sentiment coupled with abundant dry powder should result in an increase in month-to-month figures, even though sales are still well below last year’s levels.

|

GO SOCIAL

Share with your network

|

|

|

|

AUTHOR(S):

|