Disruption 2020: April Sales Volume

-

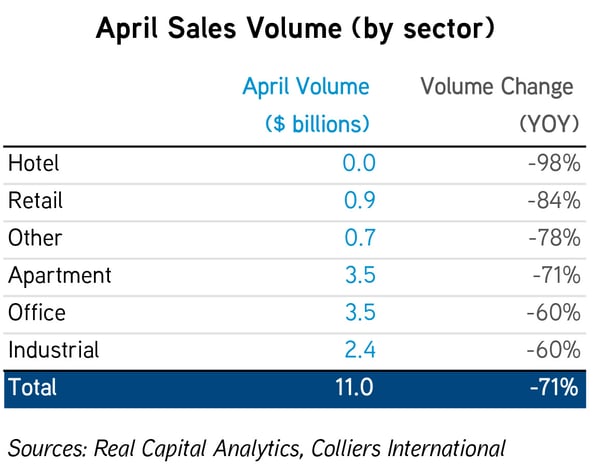

Aggregate sales volume was $11 billion, down 71% year over year. April still benefited from pre-COVID-19 agreements - that will go away with May and June numbers.

-

Hotel investment is off 98%, retail 84%.

-

Office and industrial were the least impacted, off 60%.

-

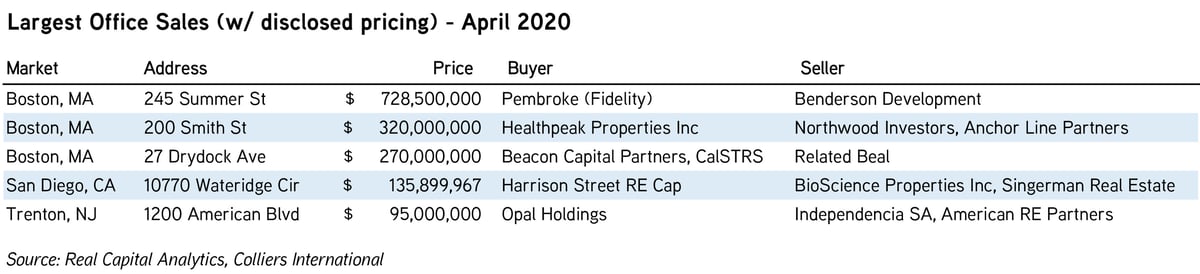

Office volume is being driven by Boston sales activity — 40% of April volume.

-

Portfolio deals in apartment and industrial drove a high share of activity in each asset class.

-

The widening gap between buyer/seller expectations has caused a significant drop in transaction activity.

-

Volume typically increases as the year progresses, so we expect May and June figures to continue to deteriorate when compared to year ago numbers.

April sales volumes across all property types plunged, per Real Capital Analytics’ latest data released May 20th. Aggregate sales volume clocked in at $11 billion, down 71% year over year. April benefited from pre-COVID-19 agreements, propping up volumes. Hotel investment has ground to a standstill, down 98%, followed by retail, off 84%. Apartment was on par with the average, down 71%, while office and industrial pulled back 60%. Despite this volume drop, pricing has held up, per RCA’s CPPI. All asset classes increased with the exception of hotel, which was down 2.2% year over year. April sales volumes across all property types plunged, per Real Capital Analytics’ latest data released May 20th. Aggregate sales volume clocked in at $11 billion, down 71% year over year. April benefited from pre-COVID-19 agreements, propping up volumes. Hotel investment has ground to a standstill, down 98%, followed by retail, off 84%. Apartment was on par with the average, down 71%, while office and industrial pulled back 60%. Despite this volume drop, pricing has held up, per RCA’s CPPI. All asset classes increased with the exception of hotel, which was down 2.2% year over year.

The highest volume office market in April was in Boston. Greater Boston posted $1.4 billion of office sales, 40% of U.S. office volume. The wider Washington, D.C. area posted $248 million, followed by Los Angeles, at $221 million. The Bay Area posted $173 million, Manhattan just $67 million, and Chicago posted virtually no volume at all. There are pending sales, particularly in Manhattan, that would quickly prop up market-level volumes, but it is clear that the pullback in volume has been widespread. Total deal activity was noted as more than double the lows of the Great Recession.

Apartment volume was propped up by PFA Pension of Copenhagen acquiring a minority stake in a portfolio, driving more than $1 billion of the asset type’s $3.5 billion in sales. Urban-centric sales were mostly absent from the largest deals in the month; instead high-growth markets in the South and Southwest topped the list. RCA reported 138 sales, nearly double the low point of 77 reached in the Great Recession.

Industrial tends to be driven by portfolio activity, which aside from Blackstone’s purchase of CSM Corporation’s assets, has dried up. That one transaction drove 20% of industrial sales activity in the month. While there were other portfolio deals, they were not of size. The largest sale of the month was an Amazon facility in Shakopee, MN, for $118.7 million. RCA’s CPPI rose 8.3% for industrial, showing the continued strength in this asset class.

Volume typically increases as the year progresses, so we expect May and June figures to continue to deteriorate when compared to year ago numbers. We are seeing a wide gap between buyer and seller expectations which has created a mismatch, and in turn, pullback in volume. That said, there are numerous non-institutional investors actively looking to buy properties, distress or otherwise.

Author:

|